Article

Feb 4, 2026

Introducing Lotus: What's In Your Vault?

Lotus is a tranched DeFi credit market designed to deliver higher yields on high-quality collateral.

At a glance

Problem: Most lending vaults cluster at the extremes: conservative with boring returns, or high-yield and stuffed with low-quality collateral and opaque tail risks.

Solution: Connected risk tiers with shared liquidity, enabling risk segmentation without fragmentation.

Outcome: Better risk-adjusted returns on collateral you’d actually hold.

Design Partners: Block Analitica, M11 Credit, FalconX, Credora, Bitwise, + 14 others.

What's in your vault?

Vaults are one of the most important financial innovations since the creation of the ETF. They've become the standard wrapper for onchain credit products because they're composable, easy to use, and let people access yield without managing positions themselves. But vaults are packaging, not the product.

The positions inside your vault matter. The risk your vault takes matters. And if you don't like the risk profile, you can always find a different vault—there are plenty of options. The problem is that when you look under the hood, most vaults start to look the same. They tend to fall into one of two buckets.

Conservative vaults lend against blue-chips with low returns. "High-yield" vaults lend against correlated collateral that could blow up. There's almost nothing in between.

Vaults are the chassis, but credit infrastructure is the engine. Until now, the engine has had only two gears.

1 → 2 → ∞

1. Start with Aave. One market, one set of parameters, the DAO as risk manager. Everyone gets the same risk profile whether they want it or not. Simple, but no room for customization. One risk profile.

2. Morpho externalized risk management. Competition among professional curators should have led to vaults that spanned the risk spectrum. In practice, vaults became bifurcated into two categories: conservative low-yield vaults and high-yield correlated-collateral vaults.

The reason is that isolated markets fragment liquidity. To avoid fragmentation, managers concentrate in pools where depth and rates are most reliable. Even though the vault layer became expressive, the market structure ultimately limited managers to just two risk profiles.

∞. Enter Lotus.

The Full Spectrum

Lotus offers a new model that lets vaults span the entire risk curve. Lenders can access new return profiles where you can earn high yields by lending against blue-chip assets.

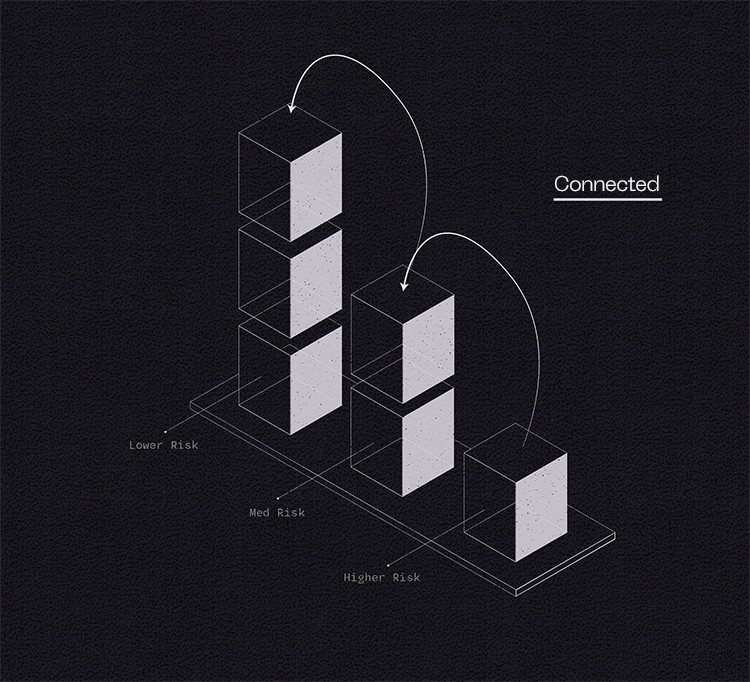

The core idea is connected tranche markets. Instead of isolated pools that fragment liquidity, Lotus markets have multiple tranches at different risk levels, with liquidity flowing from riskier tranches to safer ones (but not the reverse). Rather than the protocol dictating market parameters, you choose your spot on the risk curve, and your capital serves borrowers at your risk level or below, keeping you fully utilized.

Why does this matter? In isolated markets, fragmented liquidity ensures that only one or two sets of risk parameters can survive. In Lotus, tranches share liquidity, so every point on the risk curve stays viable and priceable. Higher risk means higher yield; lower risk means lower yield. The reward spectrum actually matches the risk spectrum.

In practice, this means you can earn a premium for lending at more aggressive parameters. Right now, the only way to earn a premium is to sacrifice collateral quality. Instead of catastrophic losses when correlated collateral blows up, on Lotus, losses are probabilistic and contained. You chose the risk, you can model it, and the yield reflects what you're actually taking on.

What We Believe

Lotus exists to build the best credit products for lenders. By "best," we mean risk-adjusted returns that reflect the risk you actually chose, on collateral you can underwrite, with transparency you can verify.

We're not promising magic. Credit has risk—borrowers default, collateral drops, and liquidations sometimes fail to cover the full amount. That's lending. If you want a riskless yield, buy T-bills.

What we're building is a system that makes risk explicit rather than hidden. Vault managers get real options rather than just two buckets. Lenders can finally get paid for taking on more risk with good collateral, rather than taking different risks with worse collateral.

We're Not Alone

“As risk managers, we’re very excited to work with Lotus. The connected risk tranches allow for designing more robust interest rate models, which leads to better risk pricing.”

Primoz Kordez, Founder of Block Analitica

"As allocators become more sophisticated and the digital asset credit market matures, demand is shifting from broad “yield buckets” to clearly engineered risk exposures. With infrastructure like Lotus, asset managers can democratize truly granular risk-profile offerings built on transparent parameters, explicit loss mechanics, and clear underwriting logic."

Thibault Labidi, M11 Credit

"Lotus's unique tranche-based lending system enables lenders to make informed decisions based on real-time risk assessments and yield-adjusted returns. We're excited to partner with them in bringing sophisticated risk management tools to a broader DeFi audience."

Mike Massari, Credora Lead

"It's incredibly exciting to see a protocol like Lotus finally bring tranches to the space. This is a massive unlock for credit desks, giving us the actual precision we need to manage our cost of capital and move away from 'one-size-fits-all' borrowing."

Simona Skvirsky, Credit at FalconX

What's Next

Now: Follow us on X

Next: A deeper technical piece on tranched markets is coming. Early integrations with partner curators and risk managers are underway.

Soon: Private testnet with design partners, followed by launch on Ethereum and Arbitrum. Independent security audits are in progress, and all reports will be published on the documentation site.

We're early. The protocol is new. But the infrastructure works, the partners are real, and the thesis is clear. Welcome to Lotus.

Get Involved

We're working with a small group of partners on early strategies.